Refunding an invoice is done via the 'Edit Invoice Screen' and will refund the invoice amount causing the original

invoice to have the full balance owing. You have the option of automatically creating a new invoice to balance

the amounts so your reports tally up.

Note: only the full amount can be refunded, part refunds are not supported.

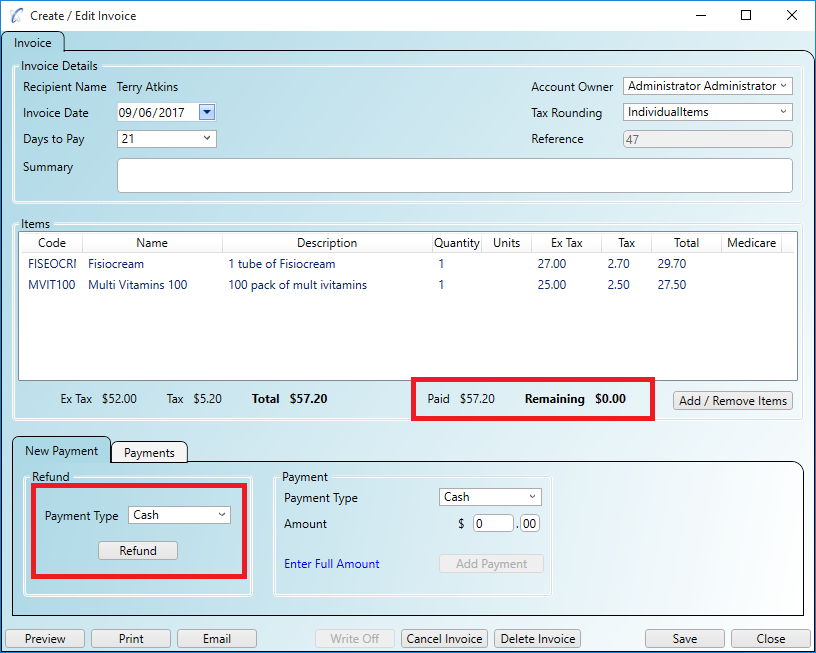

Step 1

To refund an invoice first double click it to open.

Step 2

In the 'Edit Invoice Window' click the 'Payment Type' in the 'Refund' panel and click the 'Refund' button.

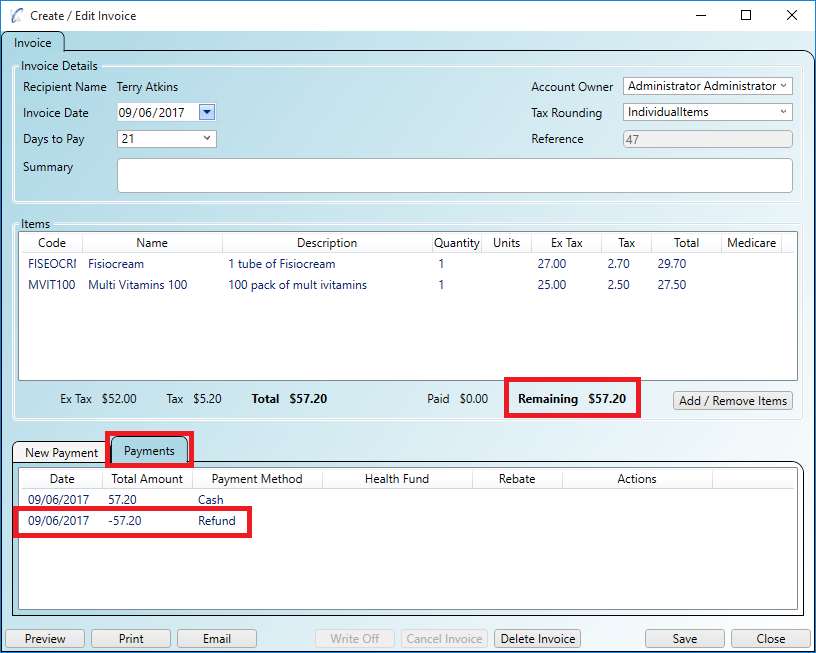

Step 3

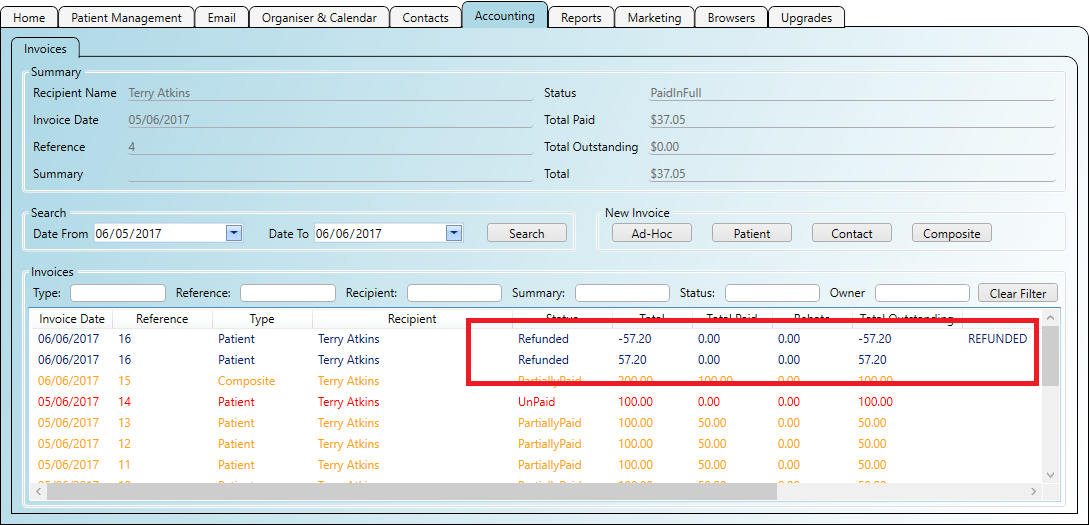

The refund adds a 'Refund Payment' which cancels out the amount paid. This leaves the invoice with the full

balance owing.

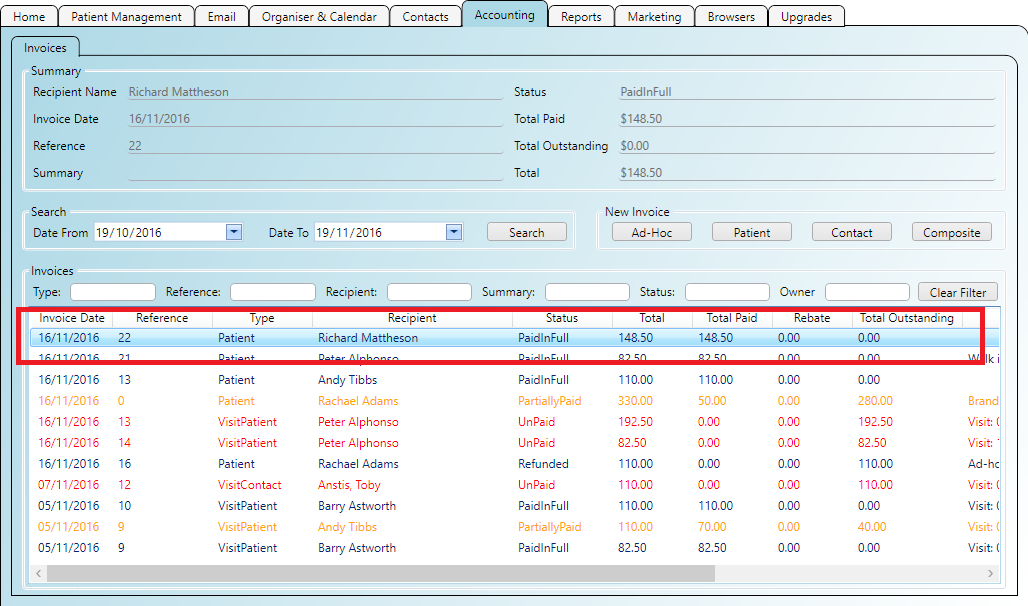

When you refund an invoice you will be given the option to create a new invoice which will balance the fees so your reports will tally up correctly. The result is shown below.

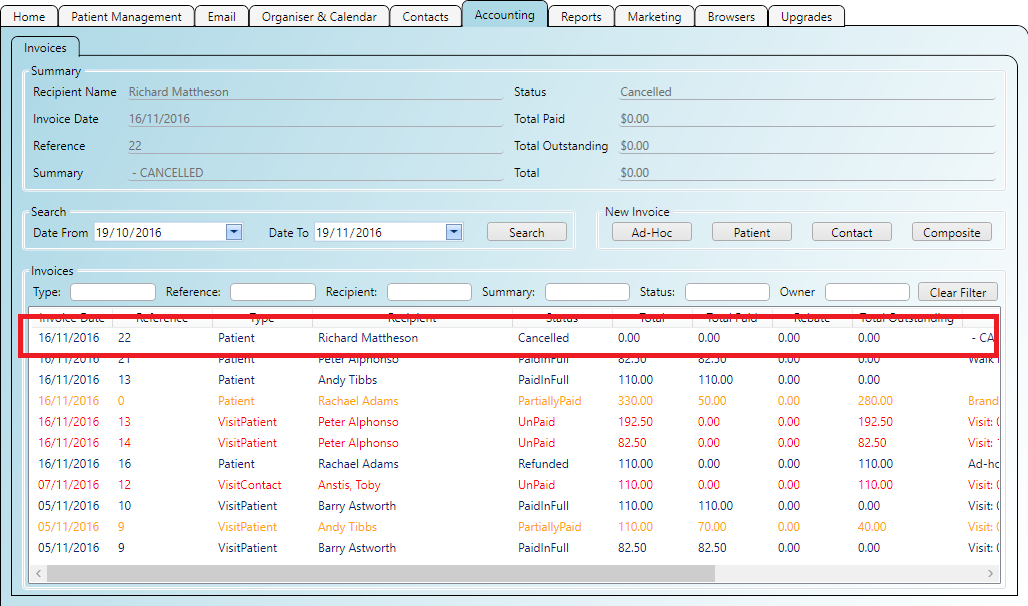

When you cancel an invoice the invoice will have its fees set to zero.

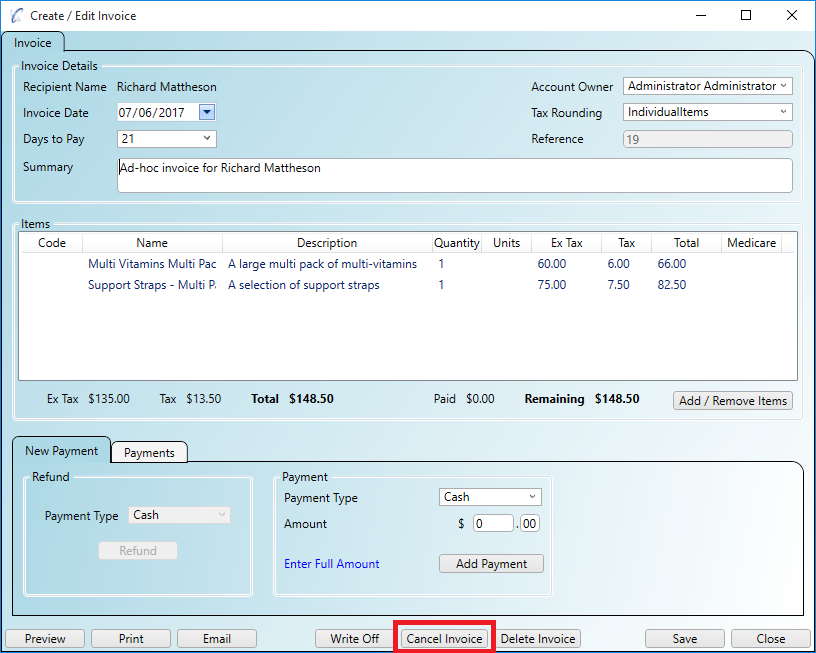

Step 1

To cancel an invoice first double click it to open.

Step 2

In the 'Edit Invoice Window' click on the 'Cancel Invoice' button.

Step 3

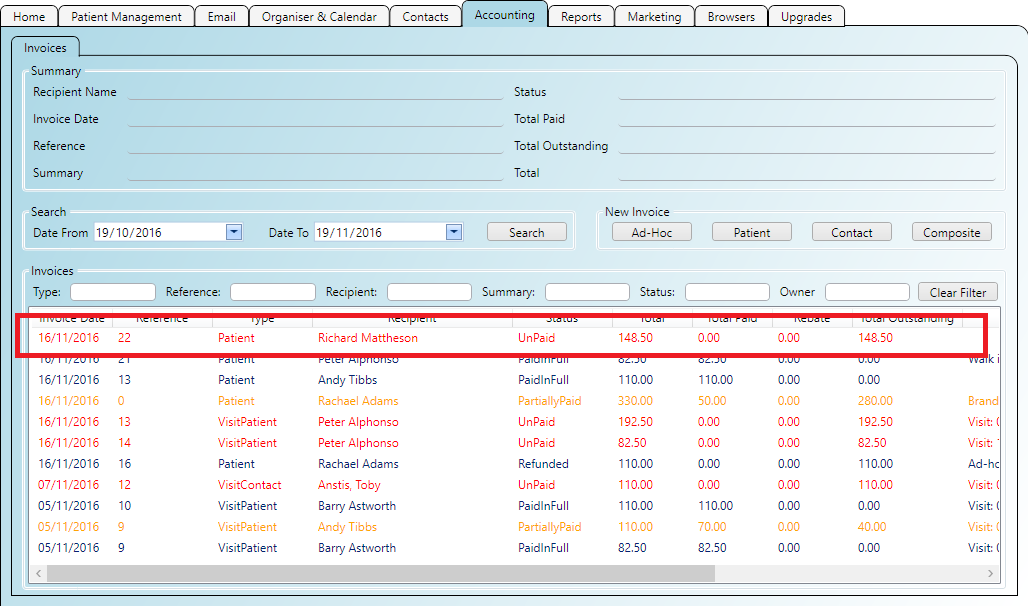

The cancelled invoice appears in the list with zero fees.