Composite invoices are composed of other invoices. They are a useful for:

There are two types of composite invoice:

Step 1

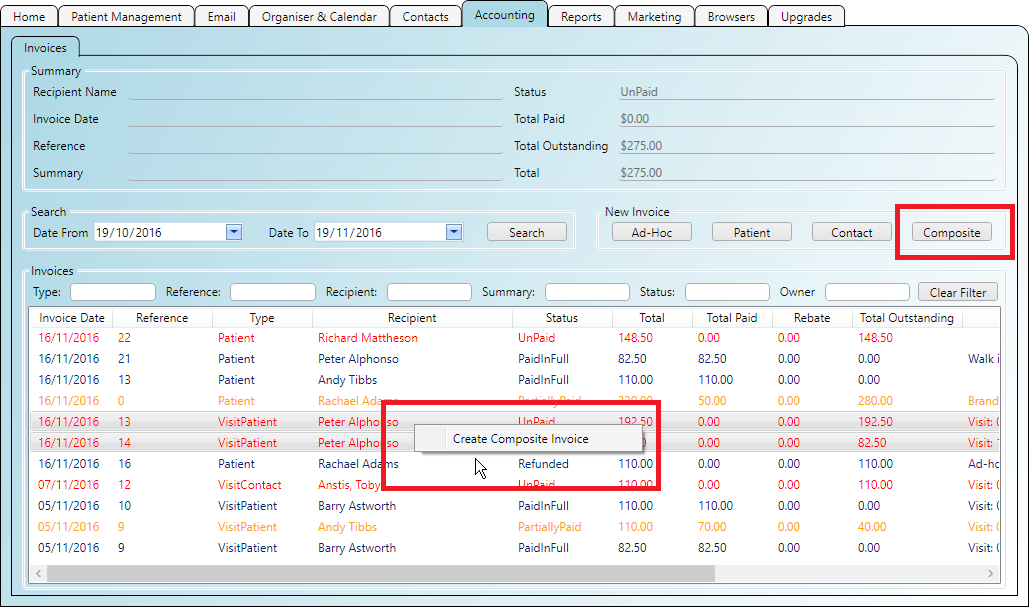

There are several ways to initiate a composite inovice:

Step 2

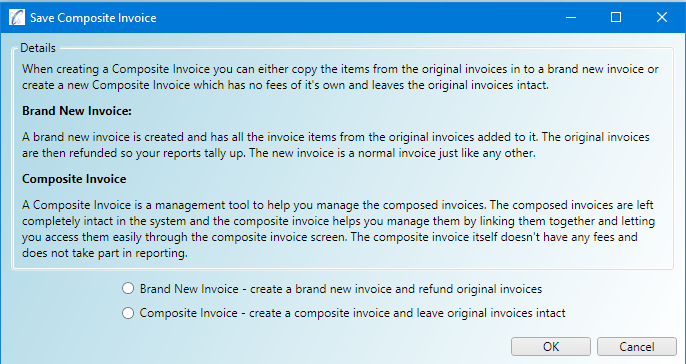

When you create a composite invoice you need to choose its type:

If 'Brand New' is selected then the following occurs:

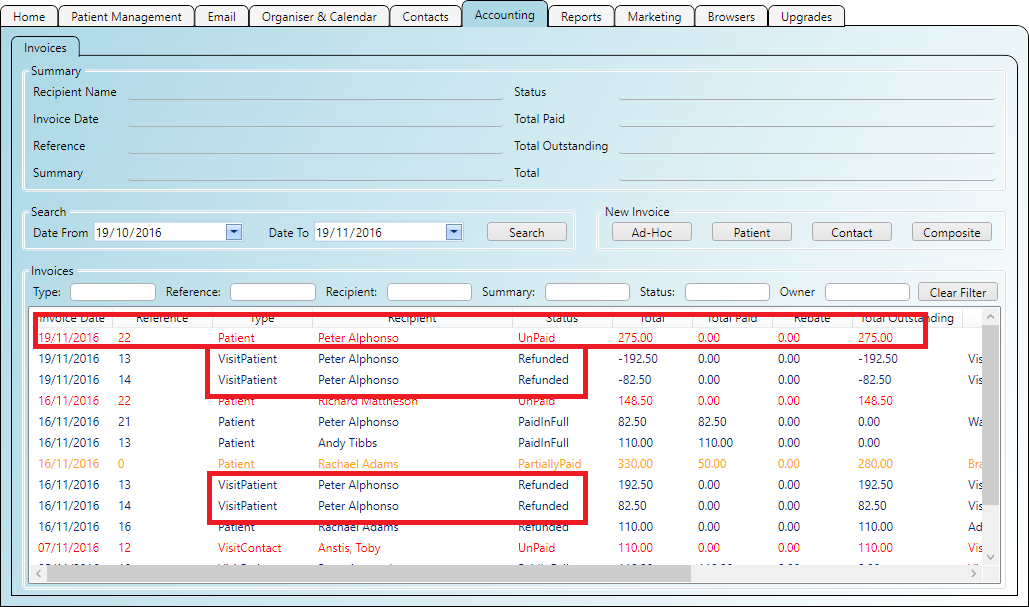

Step 1

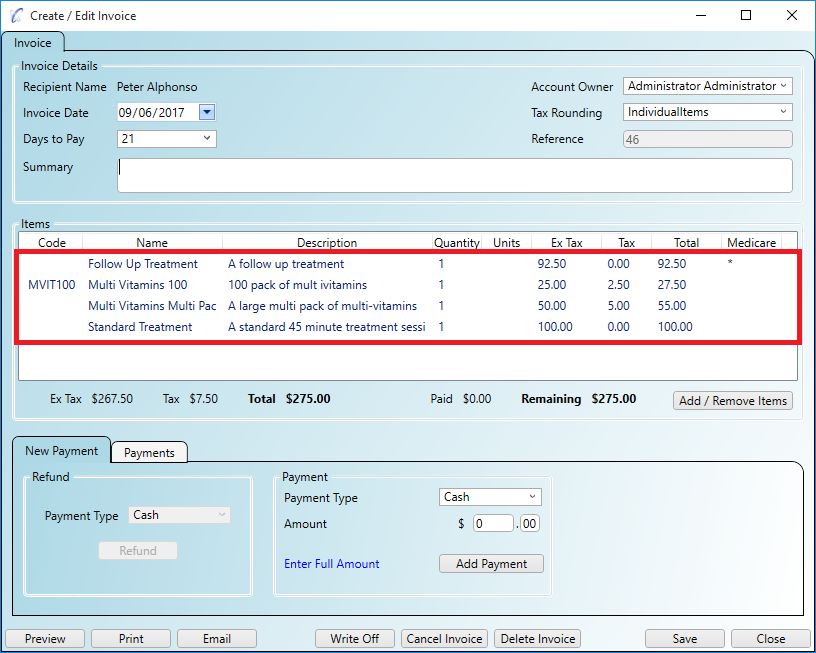

When you select 'Brand New Invoice' for your composite invoice type the original invoices are refunded and a new

one is created containing the items from the original invoices. This is a now a normal invoice and as such the

'Edit Invoice' window opens showing the items copied in.

Step 2

The composed invoices are refunded and the brand new invoice remains.

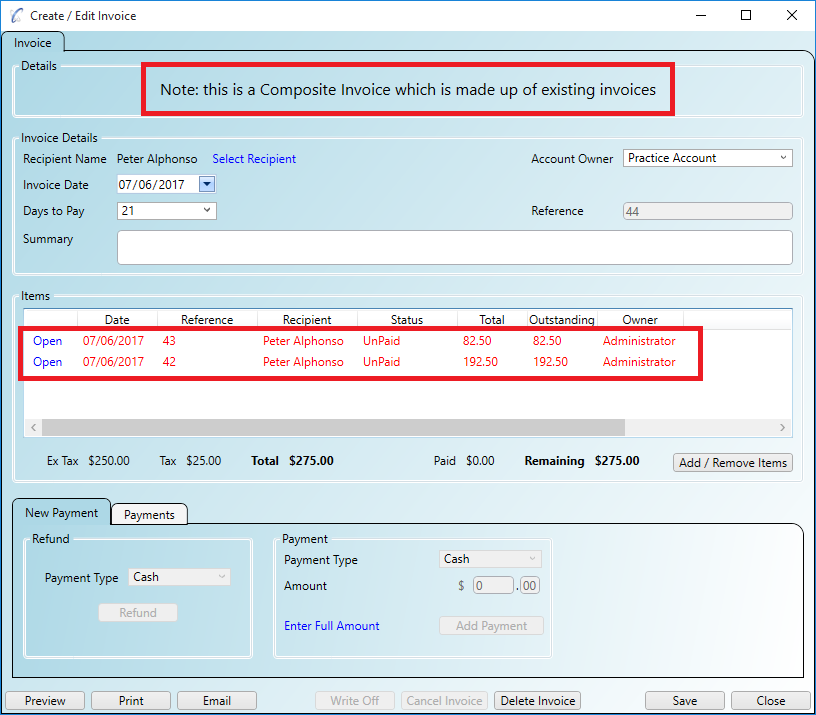

If 'Composite' is selected then the following occurs:

Step 1

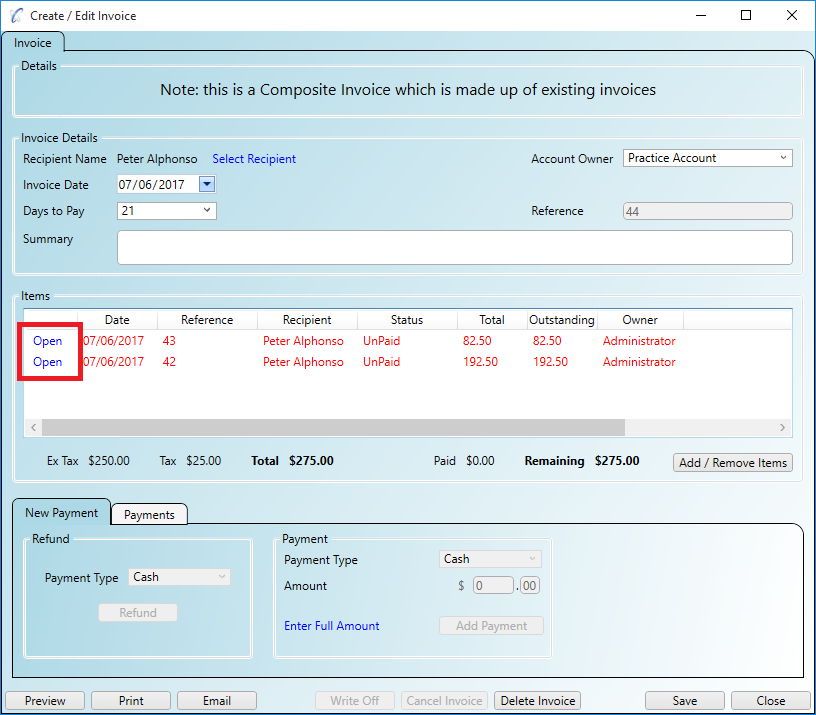

When you select 'Composite' as the type for your composite invoice the 'Edit Composite Invoice' window will appear.

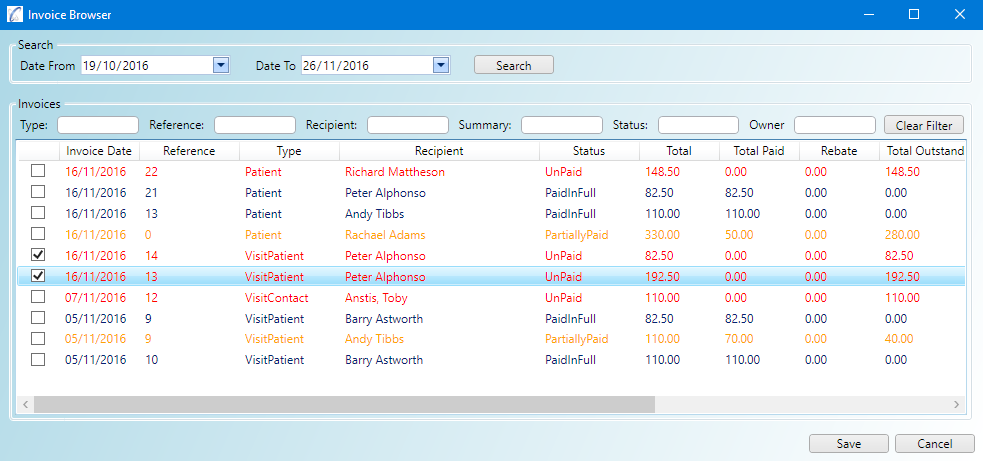

Step 2

Clicking the 'Add/Remove' button will open the 'Invoice Browser Window' for you to start adding invoices to your

composite invoice.

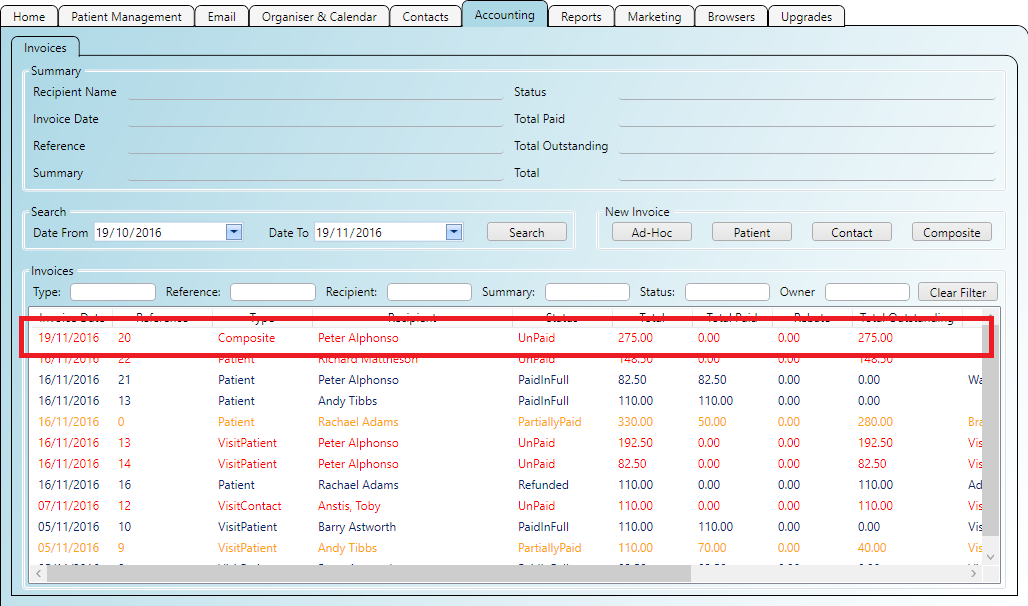

Step 3

When a 'Composite' invoice is saved it is the only invoice saved (the original composed invoices are left untouched).

Step 4

And when a 'Composite' invoice is re-opened it shows the composed invoices as items. The child invoices can easily be opened

and edited. In this way a 'Composite' invoice is a good way to manage groups of invoices.

Step 5

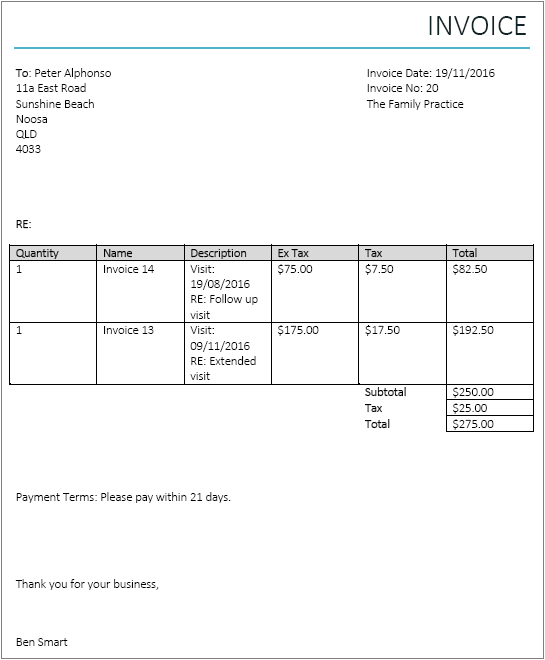

When a 'Composite' invoice is printed or emailed to the recipient, it appears as normal invoice would. Even though the items

are in fact invoices themselves they are shown in summary form as items on the printed invoice. This makes composite invoices

ideal for sending groups of invoices to a single client for processing (for example an insurance company).